This report is based on joint research by the Institute for Spatial Economic Analysis (ISEA) and Spatial Economic Intelligence Consulting, LLC (SEI-Consult). For access to the full report, please contact Christian Staack at cstaack@sei-consult.com.

There has been much speculation and analysis on where Amazon expects to locate its second headquarter. Actual, as well as self-declared experts weighed in and more than 200 cities, counties, or otherwise identified agglomerations moved to submit a bid for the seemingly once in an economic developer’s lifetime opportunity to attract the second headquarter of the company founded and still co-owned by the world’s richest man. Each one proclaimed – rightfully, and correctly, of course – that its location and no other would be the perfect fit for Amazon’s needs.

Do all those places actually believe they have a chance? If yes, many of the development officers that submitted bids must suffer from a newly discovered mental illness, called Amazullination – the belief that one’s location is clearly the best place for Amazon’s second headquarter, while all others are not quite as suitable. But maybe there is not even such illness? Maybe their bids for Amazon’s HQ2 were entirely rational?

After all, what Amazon initiated was not only a bid for its own second headquarter, what it really mobilized was a nationwide – if not multi-country – competition for next generation companies headquarter locations. In other words, any location that submitted a bid and makes it onto Amazon’s shortlist – and all submitting entities probably hope that Amazon will make such selection public – will be a winner.

The question is how to select those winners. Amazon is a company driven by data and rational choice, as many of the 21st century high tech companies need to be. In their request for proposals, Amazon specified the criteria that all applicants need to meet, implying that all locations not meeting those criteria will be excluded. We grouped those criteria into four categories:

- Transit access, which includes access to airports, highways, and rail

- Available labor force of the type needed at Amazon headquarter

- Availability of suitable land and buildings

- Quality of life measures, which includes cost of living, price categories of residential real estate, and available amenities

Amazon could then choose the locations that best meet these criteria.

In order to do so, it would need to specify preference weights (how important is quality of life relative to access to the preferred composition of the labor force?) and distance weights (how much do I value a worker with the right qualification that lives 50 miles away versus one that lives one miles away?). The location with the highest ranking would then be the location of choice. Unfortunately, Amazon did not provide information about their preference or distance weights.

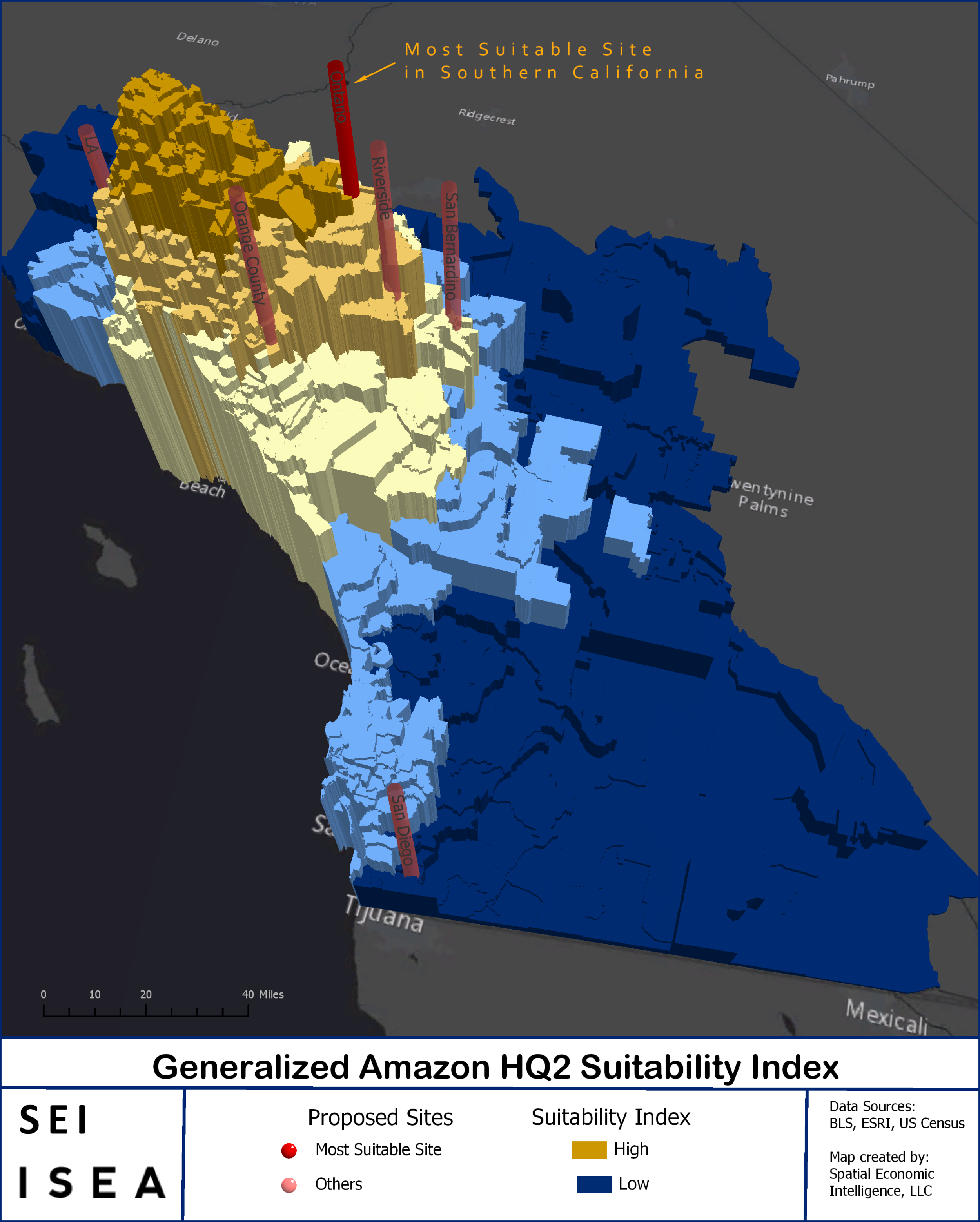

Within Southern California, using standard assumptions such as equal preference weights for their categories and regressive (logarithmic) distance weights, we can calculate a so-called suitability index for the ideal Amazon headquarter location for each zip code within Southern California. We also added sites that we are aware submitted proposals, but this list is certainly incomplete at this point. Visualizing the results leads to some interesting insights:

- Only using the criteria specified by Amazon, zip codes in downtown LA reach the highest suitability scores. However, no suitable site was offered by the city in this area.

- Of the sites offered and included in this analysis, Ontario would be the best location within Southern California based on this methodology

- Many places that submitted proposals do not meet the specified criteria, but most of them get close.

We can see that the assumptions we used are incomplete and weights have not been properly adjusted – nobody would expect Amazon to locate within downtown LA. Costs are too high and other factors like congestion have not been taken into account.

Moreover, one might think that only locations who meet the criteria have submitted proposals, but this is – rightfully so – clearly not the case in Southern California. It is reasonable to include locations that are suitable, but not perfect yet. Improvements, e.g. a missing rail link, can be committed to during negotiations.

As a next step, we therefore include all locations within Southern California and see how they fare:

Not surprisingly, the order of suitable locations does not change. Among all the submissions included, the Ontario location still assumes first place. Given that we do not know Amazon’s preference and distance weights for their criteria, any of the higher ranked competing locations could be the winner if Amazon decided to locate their HQ2 in Southern California.

Another useful insight these results provide is how well locations in Southern California are suited as headquarter locations for other companies, large and small. The results imply that the competition between Riverside, Irvine, and Ontario for headquarter locations in Southern California could be fierce.

Some may wonder why San Diego – certainly a wonderful place to live and a tech center in its own right – does not seem to fare so well in this analysis. The reasons are threefold: San Diego has high costs of living, which negatively affect the quality of life sub index. San Diego’s location close to the border and the Pacific Ocean limits its reach to the South and West in terms of available land, labor, and attractions, while places like Ontario have access to all of these in all directions. Finally, the type of labor pool Amazon is looking for is more prevalent in the greater LA area than in San Diego.

The example of San Diego illustrates an important point: suitability is an idiosyncratic concept and needs to be adjusted at least by company size and industry. If we had constructed a suitability index for mid-sized biotech companies, we would have expected San Diego to rank much higher, if not in the top category. More generally, this methodology can be usefully applied to find locations for companies. All that is required is some knowledge about the criteria and their relative importance for those companies and their headquarters. Doing so by industry and possibly company size could help each location within a region to sharpen their profiles and market their locations to the industries their location is best suited for. This fosters beneficial cluster formation and economic growth while providing a service to firms interested in relocating.

Back to Amazon – should Amazon locate to Ontario? If we second-guessed Amazon’s preferences right and this was all they cared about, clearly yes – as long as they chose Southern California as a region to relocate to.

But clearly, there are many other factors that are not specified in their request for proposals. And this is where the location specific information each proposal contains comes into play. Aside from strategic considerations for future negotiations, all this extra information is valuable to Amazon for reaching a final decision. I If they had only been interested in the data driven solution, they could have done this already and then approach cities most suitable. This favors the view that other factors matter to them. Nonetheless, the suitability index analysis helps to learn about how costly it is to give up any of the criteria.

Amazon has the unique chance to cater a substantial public service to all those places submitting without much cost: Offer feedback through their selection process. Amazon could provide a complete ranking, reveal their weighing mechanism and sort all proposals into categories, such as:

- Exceeds our demands

- Meets our requirements

- Needs development in few areas

- Needs development in many areas

They could then publicize the first two categories and secretly inform all other submitters. This would be nice marketing for the submitting entities included it in the first two categories and help all others to get ready for the truly big competition for next generation headquarters. If they did so, none of the tremendous efforts spent by the many around the country to make their places look good would be wasted.

About the University of Redlands Institute for Spatial Economic Analysis (ISEA)

The Institute for Spatial Economic Analysis (ISEA) serves regional, national and global business and government leaders in their needs to better understand how socio-economic phenomena affect their communities. A division of the University of Redlands School of Business, ISEA publishes ongoing, timely reports covering retail, employment, housing, logistics and other special topics. A key distinction of the Institute is its ability to illustrate economic trends and patterns through the use of geo-spatial mapping techniques. In addition, ISEA’s ability to provide Zip code level analysis for many of its reports provides unprecedented detail. Current ISEA economic data and interactive maps may be found at http://www.iseapublish.com/map

About SEI Consult

SEI Consult is a boutique economic consulting company, specializing in big data driven spatial economic intelligence. We have created a proprietary, big data processing algorithmic framework, gathered substantial data sets and are able to gauge the impacts of future economic developments down to the zip code level. With this spatial economic intelligence data, we can advise institutions on economic development issues. We specialize in preparing local institutions for the challenges accelerating automation creates for them, especially in these fast changing economic environments.